The Complex Landscape of Carbon Accounting: A New Scope Emerges

The methods companies use to measure and report greenhouse gas (GHG) emissions are in a constant state of evolution. As the urgency to address climate change intensifies, so does the scrutiny surrounding carbon accounting practices. Currently, many industries are grappling with changes to existing carbon accounting rules that would introduce a way to measure and take credit for “avoided emissions.” Some propose creating a new category of corporate GHG emissions called “Scope 4 emissions.” This development has significant implications for businesses and raises questions about the future of carbon accounting.

Scope 4 emissions, as proposed by organizations like the Partnership for Carbon Accounting Financials, center around the concept of “avoided emissions.” This framework would allow entities such as banks to measure the emissions they help avoid through their financial activities; for example, loans to finance the decommissioning of fossil fuel plants. In theory, this concept aims to incentivize climate-positive actions. But in practice, it also introduces new complexities and challenges to a carbon accounting system already in need of a business-friendly overhaul.

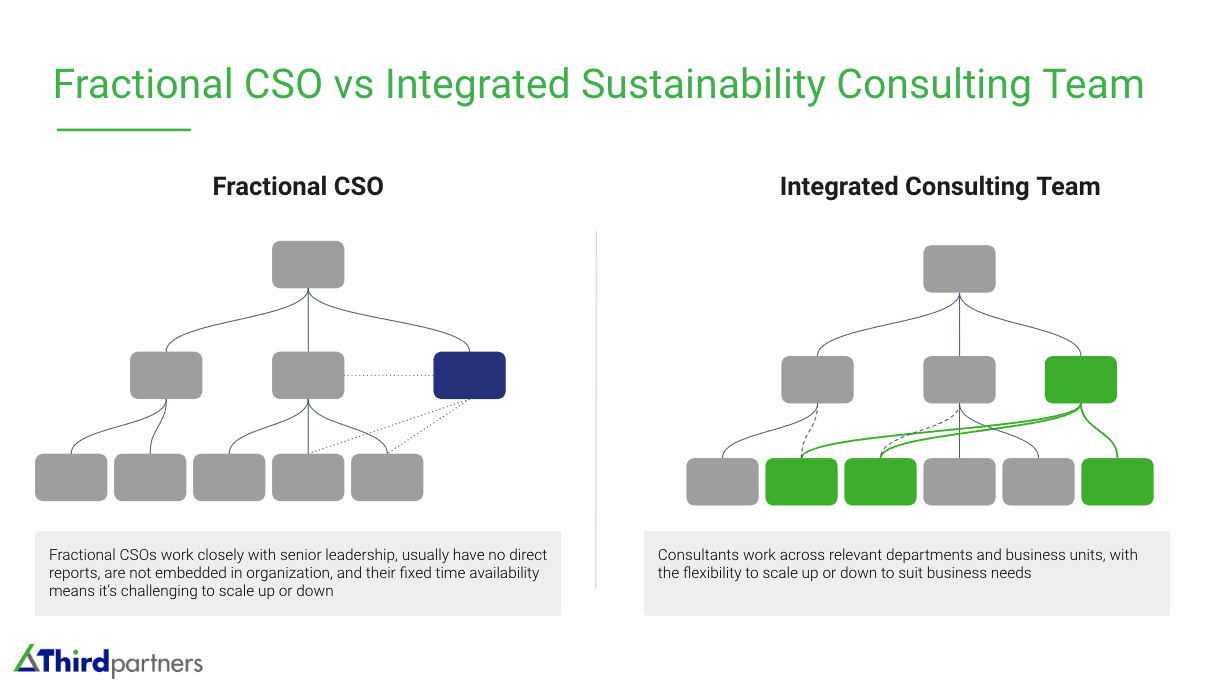

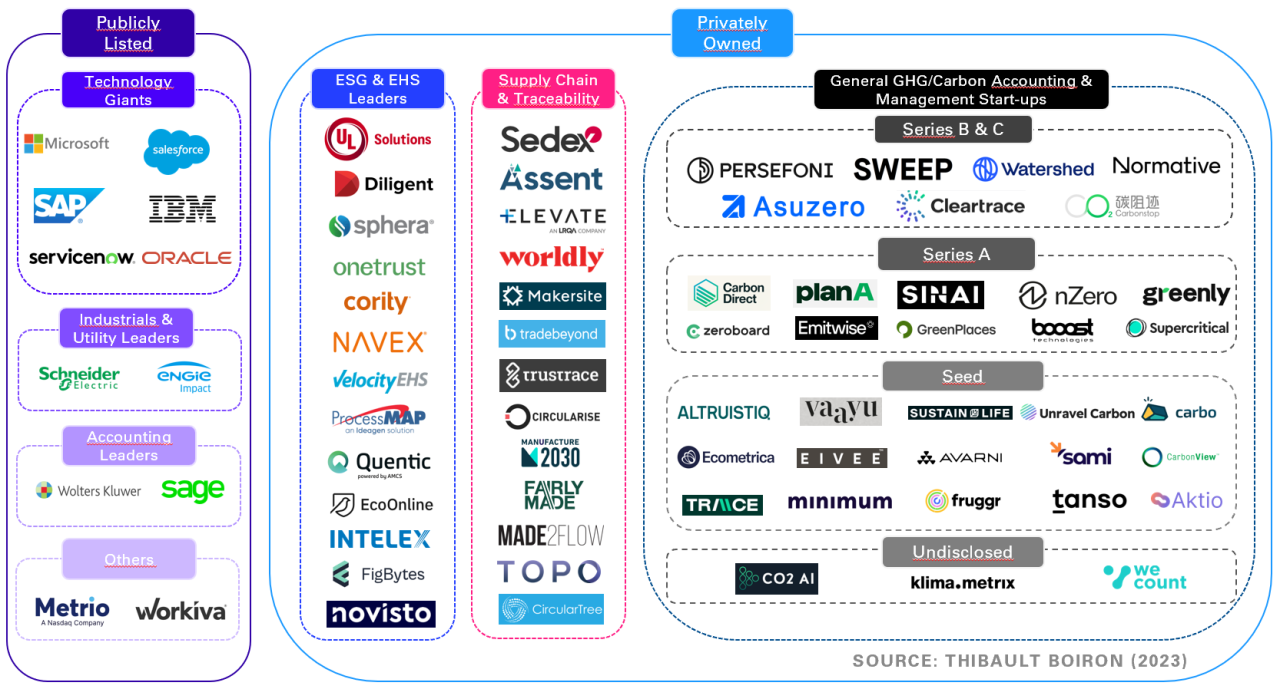

The Current Carbon Accounting Landscape

Existing carbon accounting practices, governed by frameworks like the Greenhouse Gas Protocol, are already complex, imprecise, and problematic for businesses to implement. The market for technology tools to track emissions continues to grow faster than the universe of actionable solutions for companies (Source: Carbon Emissions Tech Canvas). Tracking GHG emissions related to business activities, especially “Scope 3” emissions that encompass a company’s supply chain, often involves estimations and can be hampered by a lack of good quality data. Additionally, the current system struggles to quantify emissions reductions effectively, relying heavily on a “carbon credit” model. The introduction of Scope 4 has the potential to exacerbate existing issues like double counting and ambiguity, further complicating the landscape.

E-Liability: A Potential Solution

As the limitations of current carbon accounting practices become increasingly apparent, alternative approaches may be required in order to fix the current system instead of introducing additional “scopes” such as Scope 4. One such approach is E-liability, which treats GHG emissions as liabilities recorded in environmental ledgers. These E-liabilities are transferred along the supply chain, mirroring the flow of physical goods. This method offers a more comprehensive and accountable approach to carbon accounting, but its implementation is not without challenges. For E-liability carbon accounting to become the norm, a number of different economic stakeholders will need to collaborate.

The Road Ahead

The only thing certain about the future of carbon accounting is that the current system is burdensome, inefficient, and largely incompatible with how business operates. While revisions to existing frameworks like the Greenhouse Gas Protocol are underway, professionals in finance, accounting, and sustainability management are holding their breath for greater simplicity, not more complexity. Adding a “Scope 4” element to an already flawed system promises to open the floodgates to more fuzzy accounting, greater frustration, more questionable claims.

Adopting an entirely new framework, such as E-liability emissions accounting, may be necessary to align businesses globally on action, not just accounting. For businesses, navigating the carbon accounting landscape can be daunting. If you are struggling to get started with carbon accounting, or are interested in exploring alternative methods like E-liability, reach out to Third Partners to discuss forward-looking solutions.