Video: Sustainability consultants Adam Freegood and Bryce Rasmussen explain the new SEC Climate Rule and California’s Senate Bill 253. The new regulations, along with other sources of pressure, impact carbon emissions and climate risk disclosure for companies.

What is the SEC Climate Rule?

The SEC Climate Rule has become a frequent point of discussion since its approval on March 6, 2024. This move comes as part of a global effort to enhance transparency and accountability regarding environmental issues. Public companies must disclose their greenhouse gas emissions, climate-related risks, and strategies for mitigating these risks. This regulation directly affects around 2,800 large public companies, many of which already comply.

What is California Senate Bill 253?

California has implemented its own legislation called SB 253. Companies with revenues greater than $1 billion USD have to report their direct and indirect (Scope 1, 2, and 3) greenhouse gas emissions beginning in 2025. While the SEC rule primarily targets public companies, SB 253 affects a broader swath of private and public companies doing business in California. Thus the CA law may be more consequential for companies.

How important are the SEC climate rule and CA SB 253 to a company’s overall ESG and sustainability reporting?

The actual impacts are nuanced and, for the near term, primarily impact how large companies prepare annual reports. It will be tempting for many companies to outright dismiss these new rules, however, there are factors beyond the government to think about.

When it comes to GHG measurement, goal setting, reporting, and the bottom line, customers and investors are forcing change faster than regulation.

The Three Factors to Consider: Investors, Customers, and Business Costs

1. Investor Expectations

When it comes to corporate sustainability disclosures, investors prioritize risk management, particularly regarding energy and greenhouse gas emissions.

In particular, Private equity firms aim to prepare companies for exit within 3 to 5 years, meaning companies have a short window of time to get their climate strategies and reporting up to standards. The ESG Data Convergence Initiative requires portfolio companies (PortCos) to manage a range of energy, carbon, and climate related business factors for private equity firms that report to the EDCI. PortCos will be surveyed on financial risk related to energy costs, carbon taxes, and direct exposure to climate related risks (e.g. extreme weather, supply chain disruptions, crop failures, water scarcity, etc).

Understanding this could present an opportunity for mid-sized companies to differentiate. By addressing climate risks and disclosing their action plans, companies can enhance their reputation and attractiveness to investors. However, unlike larger corporations with dedicated sustainability departments, mid-sized companies may lack the expertise and experience needed to compile accurate and comprehensive disclosures. They may need to invest in training or seek external assistance to ensure compliance.

2. Customer Demands

In a given year many mid-sized companies will receive not one, but several, requests from customers for data on GHG emissions, energy/GHG reduction targets, and risks associated with climate change. Mid-sized companies with complex supply chains will have additional challenges assessing and managing climate risks. Suppliers may come under scrutiny for their environmental practices, prompting buyers to reassess their partnerships and look for more sustainable alternatives.

Buyers cascade sustainability requirements down the supply chain, impacting all suppliers. Compliance depends on the specific rules followed by the buyer, such as California’s comprehensive reporting requirements.

3. Financial Costs

Rising energy costs and climate-related risks significantly impact a company’s cost of goods sold. Executives are now focused on reducing energy costs and emissions to improve operational efficiency and meet customer demands. A win-win for companies is to create a carbon reduction roadmap that results in real operational cost savings and satisfies customer demand for GHG targets, disclosure, and reduction.

Implementing the necessary systems for tracking and reporting greenhouse gas emissions, conducting risk assessments, and developing mitigation strategies requires companies to budget for tools and expertise. However, companies can capture more potential savings than at any point in history through the many federal and state programs that help businesses access free or reduced cost technical assistance to reduce operational energy costs and pursue on-site energy to improve resilience.

In Conclusion

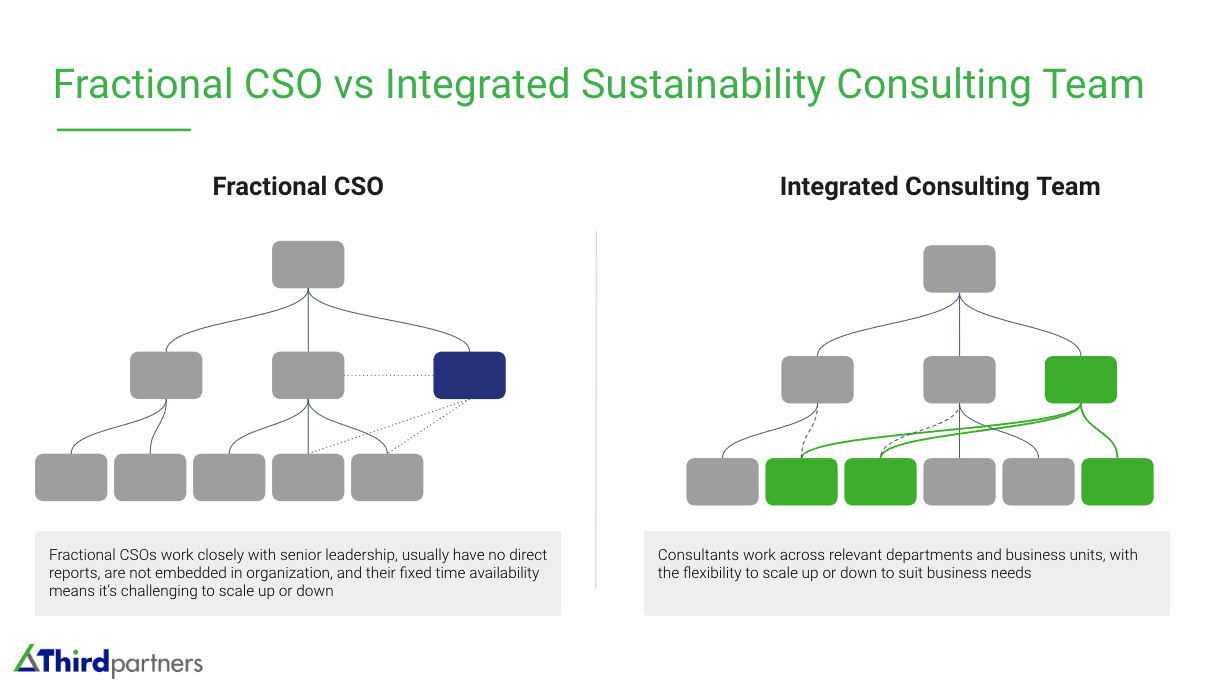

The team at Third Partners helps clients navigate sustainability consulting and strategy. Whether you need a decarbonization strategy, a recommendation for GHG / energy management software, or a custom data solution to embed energy management in your existing EH&S or operational excellence program, we offer solutions to strengthen your business and demonstrate your commitment to sustainability. If you are interested in learning more, contact us for a free consultation.