July 2025 Update:

EDUR is continuing to face pushback. Earlier this month, the European Parliament voted to reject the proposed country benchmarking system, which aimed to categorize countries into three levels (low, standard, high) based on deforestation risk. The original system received criticism as many did not feel that it accurately reflected the current level of risk and would impose unnecessary due diligence burdens.

Opposition like this could potentially lead to delays, but companies should not wait to put a compliance plan in place. Here’s why:

- It is likely that EUDR will eventually be implemented. Many commodity-level suppliers are aware of the regulation requirements. For those who are not, it’s crucial that buyers start to inform them of the plot-level sourcing information they will need to provide. Companies can use this time to conduct a readiness assessment and determine how you’ll collaborate with suppliers that currently lack the necessary information.

- Beyond compliance, mapping your supply chain can provide other benefits and opportunities. Enhanced visibility supports improved risk management, operational efficiencies, and brand protection.

Read on for our guidance on how to prepare for compliance.

—————————————————————————————————–

Can you comply with EUDR without a consultant or software? Yes, here’s how.

Many companies need to comply with European Union Deforestation Regulation (EUDR) but don’t know where to begin. If your company lacks in-house GIS expertise to analyze deforestation risk, you may be considering a full-service EUDR compliance solution. However, if your business doesn’t have the volume to necessitate that level of support, there are other options. This article will outline a number of “DIY” tools that can help your company achieve compliance.

Policy requirements refresher:

The first step is to understand the policy requirements. See our previous article for an overview of the regulation and important deadlines.

The EUDR regulation applies to any “operator” who places relevant products on the EU market, including via import or export, in the course of commercial activity. This means that any U.S. company that directly uses, produces, or trades commodities linked to deforestation, which include cattle, cocoa, coffee, palm oil, soya, rubber, and wood, must conduct due diligence and ensure their products are not produced with materials that contribute to deforestation. However, direct responsibility for compliance falls on the importer of covered products into the EU. Therefore, upstream and downstream supply chain participants will need to coordinate with their partners to share necessary information.

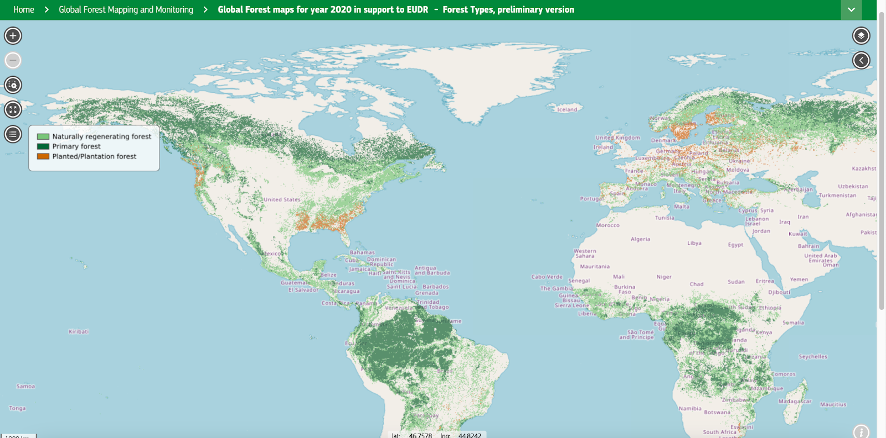

The policy defines deforestation as the conversion of forest to agricultural use, whether human-induced or not. Forest degradation refers to structural changes to the forest including conversion of primary forests into planted or plantation forests, and naturally regenerating forests into plantation forests.

For more specific details, the EU has published an FAQ page that goes in-depth on a variety of topics related to the regulation.

Tools for each step of EUDR compliance:

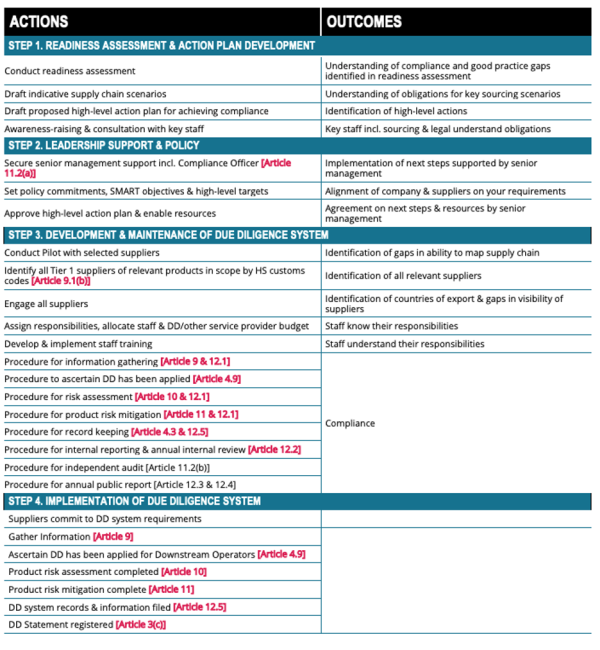

Before diving into initial information collection, your team may find it helpful to create an EUDR action plan. Environmental nonprofit WWF has a 70-page guide to EUDR compliance, and one of the most useful resources included is a step-by-step breakdown of the process. This guide divides the compliance process into four steps, with actions and outcomes clearly outlined. It is a great starting point for companies to create their own internal EUDR compliance roadmap.

Information Collection

- Internal risk assessment: Collaborate with procurement leads to identify a list of suppliers for EUDR-covered commodities, including purchasing volumes and origins.

- Supplier survey: Utilize survey tools (e.g., Google Forms, SurveyMonkey, Qualtrics) to gather location-specific data on raw material origins (down to the specific forest unit) from suppliers.

Risk Assessment

- EU Global Observatory: Obtain forest type and cover maps to analyze against your wood/forest product sourcing origins.

- QGIS: Free online tool used to generate the necessary “shapefiles” of your supply base, which you’ll upload to the EUDR online registry.

- Global Forest Watch: Online platform that provides data and tools for monitoring forests worldwide, with near-real-time alerts on deforestation. Useful for visual inspections on small supply chains.

- Global Forest Watch Pro: Mapping tool designed for leading companies and financial institutions to translate geospatial data into actionable insights. Allows users to analyze and monitor sites along their supply chain. Includes many collaboration features and is free for up to 5,000 per-location analyses and 100 million hectares of processing.

Due Diligence Reporting

- EUDR online portal: This is the online system that will be used to create a registration number for each of your EU-bound shipments. Create an account, familiarize yourself with the platform, and understand data requirements before the end of the year.

What if the EUDR regulation is modified, walked back, or changed?

The real question to be asking is: “Do you operate in a competitive market where responsible sourcing is a differentiator for your buyers?”

With trade wars brewing, there is considerable uncertainty around global trade in general. EUDR is just one of many programs that could be impacted by tariffs and new conflicts between longtime trade allies. During policy negotiations in 2024, countries lobbied for exemptions or reprieve from EUDR reporting requirements on the basis that their forestry practices presented little or no deforestation risk. Ultimately, these exemptions were rejected in order to create a level playing field and prevent corruption of the anti-deforestation process.

In 2025, anything could happen. Regardless, EUDR is the law and it goes into effect at the end of the year. Hundreds of companies that deal in forest-based commodities, or commodities known to contribute to deforestation, have prepared their compliance systems. This means that even if regulations are modified or walked back as a result of trade wars, there are hundreds of companies that are newly equipped with detailed supply chain data to support competitive sustainability claims that would not have been possible a year or two earlier.

How brands benefit from better raw material traceability, with or without EUDR

- Meeting buyer expectations. Buyers have been demanding increased raw material traceability for years. Companies can obtain market differentiation by sharing data and assurances backed by real sourcing data. Many of the seven core commodities covered by EUDR do not have turnkey certifications or ecolabels that address deforestation-specific risks of derivative products. Take leather for example. The LWG certification is used by leading leather manufacturers serving automotive and furniture supply chains primarily covers facility-level environmental and social impacts. LWG does not require traceability of raw materials for deforestation-free assurance purposes. The only way to prove deforestation-free sourcing is to do the work by mapping the supply chain and analyzing deforestation and legal risks.

- Legal and financial risk management. Illegal and unsustainable sourcing practices pose a material financial risk to companies. This is true even if companies are not aware of the risks. There have been major legal enforcement actions over the years where companies were held liable for supply chain practices linked to deforestation. As trade wars heat up, will import and export related enforcement actions increase or decrease? That answer is crystal clear.

- Consumers demand greater transparency. According to consumer insights research, 54% of consumers want information on a product’s biodiversity impact to be listed on product labels. When it comes to B2C transparency on deforestation-risk, most brands simply do not have the internal business processes and supply chain data systems to provide the transparency that consumers demand. Ingredient and packaging supply chains are notoriously opaque and most companies only collect responsible sourcing data from Tier 1 (direct) suppliers.

When do you need software to comply with EUDR?

A DIY approach to EUDR compliance only works up to a certain point. If you ship hundreds or thousands of container loads of product to the EU annually, you will need an automation solution such as software, consulting, or a combination of both.

However, there are thousands of companies that qualify as “operators” under EUDR and have lower export volumes. This includes startups and high-growth U.S. CPG companies that may be eyeing European expansion in years to come. To realize global growth ambitions, brands may benefit from consulting and in-house compliance solutions today, with technology automation playing a role at future points of growth. Because fast-growing companies are typically investing in PLM and ERP systems internally, it is entirely possible to sync EUDR compliance requirements with the reporting specifications for internal business systems.

If you need extra support for EUDR compliance, raw material traceability, B2B or B2C transparency, Third Partners can help.

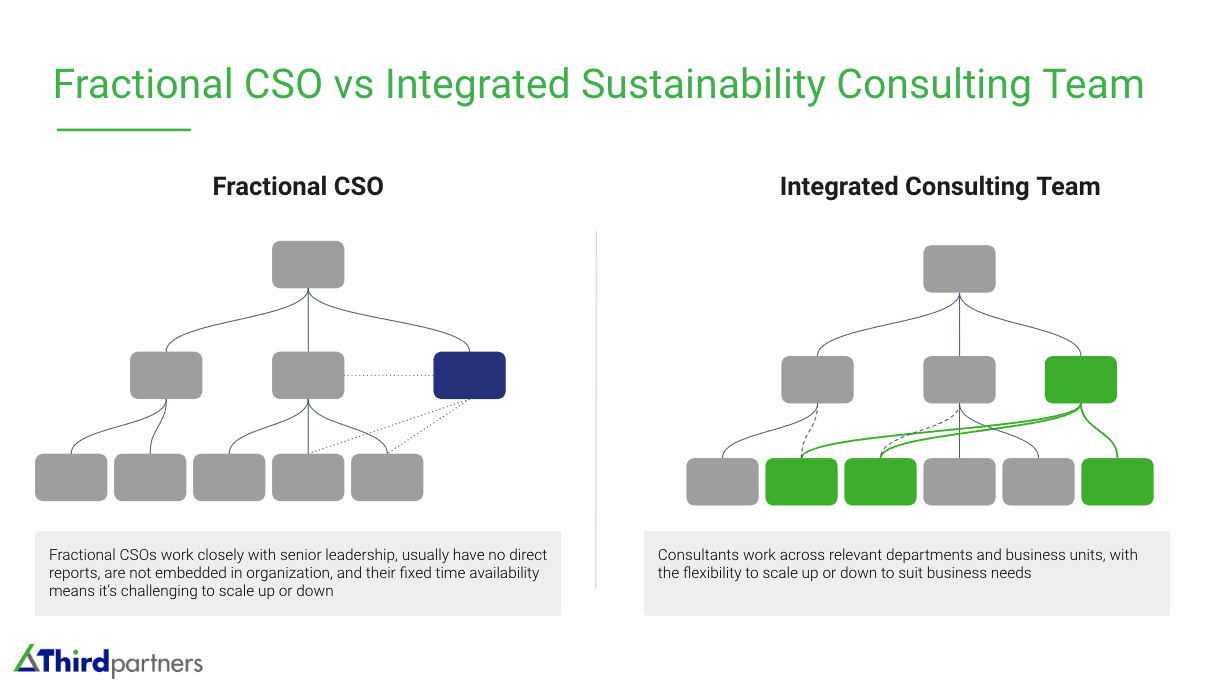

We are an independent consultancy that works with brands and manufacturers from all sectors. Unlike certifiers, auditors and larger firms, we help you get from where you are to where you need to be, without bloat or fluff. In the case of EUDR, this means we’ll help you determine the leanest way to comply, whether that is a DIY in-house solution, configuring your existing PLM and ERP software, adopting open source third party tools, or purpose-built technology. The right option for you depends on your specific business situation. Get in touch today to discuss your EUDR compliance or product traceability challenges.