The Current ESG Paradox

Defining ESG and its Strategic Ascent: Environmental, Social, and Governance (ESG) criteria have transcended niche status to become a core component of corporate strategy, risk management, and long-term value assessment for US companies. The framework evaluates a company’s environmental stewardship, social responsibility, and governance quality. ESG factors are now key elements influencing brand reputation, investment decisions, and talent acquisition.

The Central Tension of 2025: The current ESG landscape is marked by a significant paradox. On one hand, the strategic integration of ESG continues, driven by perceived links to resilience, efficiency, and stakeholder demands. On the other hand, US companies, particularly mid-market firms ($100M-$2B revenue) with global operations, face formidable headwinds:

- Political Backlash (US Focus): The return of the Trump administration has intensified anti-ESG rhetoric, labeling it “woke capitalism”. This translates into potential federal deregulation (e.g., the indefinite stay of the SEC climate rule), increased political pressure, and heightened litigation risks from both conservative (challenging DEI initiatives) and progressive groups (alleging greenwashing).

- Economic Volatility: Persistent concerns about inflation, interest rates, potential tariffs, geopolitical instability, and supply chain disruptions force difficult trade-offs between short-term financial pressures and long-term ESG investments.

- Regulatory Fragmentation: A stark divergence exists between the uncertain US federal approach and proactive state-level mandates (e.g., California’s SB 253/SB 261) and stringent international regulations (e.g., EU’s CSRD and CS3D). This creates a complex compliance patchwork for companies operating across jurisdictions.

Mid-Market Challenges: US companies with revenues between $100M and $2B are particularly squeezed. They often lack the resources of larger corporations to navigate complex regulations and data requirements while facing increasing ESG data demands from larger customers needing to report their own Scope 3 emissions.

The Rise of “Greenhushing”: In response to the political climate, many companies are adopting “greenhushing” – continuing ESG initiatives internally but deliberately reducing public communication to minimize scrutiny. While potentially mitigating immediate political risk, this strategy risks alienating stakeholders who value transparency and obscuring genuine progress.

Strategic Adaptation

Shifting Priorities Towards Materiality and Value: Amidst the volatility and political noise, a strategic adaptation is underway. Companies are increasingly focusing ESG efforts on issues with a clear and defensible link to core business value and financial performance. This involves:

- Prioritizing Financial Materiality: Conducting assessments to identify and concentrate on ESG factors most relevant to their specific industry, risk profile, and long-term value creation (e.g., climate risk, operational efficiency, human capital management, cybersecurity).

- Embedding ESG in Risk Management: Integrating ESG considerations into comprehensive Enterprise Risk Management (ERM) frameworks, recognizing ESG not as a separate silo but as a lens for identifying and managing operational, regulatory, and reputational risks.

- Leveraging “Common-Sense” ESG: Emphasizing initiatives with clear operational benefits and less political charge, such as worker health and safety, energy efficiency, cybersecurity, and talent retention strategies.

- Focusing on Talent: Recognizing the critical role of the ‘Social’ pillar, particularly employee well-being, in attracting and retaining essential talent, especially in competitive markets.

Adaptation Over Abandonment: While economic pressures lead some to consider ESG budget cuts, the dominant trend appears to be strategic refinement rather than wholesale retreat. The recognized link between ESG and long-term resilience, efficiency, and stakeholder trust provides a strong business case for continued, albeit more focused, investment. Companies are adapting by integrating ESG into financial planning and emphasizing initiatives with tangible returns.

Investor Dynamics on ESG: US vs. The World

Investor sentiment and fund flows present a mixed picture.

- US ESG Fund Outflows: US-domiciled sustainable funds experienced significant net outflows in 2023 and 2024 ($13.3B and $19.6B respectively), driven by underperformance relative to conventional peers (especially in equity), the US political backlash, and greenwashing concerns. New fund launches slowed dramatically.

- Declining US Retail Enthusiasm: Survey data shows a sharp drop in ESG enthusiasm among younger US retail investors, linked to economic uncertainty and pessimism.

- Persistent Institutional Focus (Nuanced): While some institutions may shift away from explicitly labeled ESG funds, many continue to integrate material ESG factors into their core risk analysis and long-term investment strategies, viewing it as part of fiduciary duty. Engagement on climate risk and human capital remains a priority.

- Global Growth Continues (Led by Europe): Despite US outflows, global sustainable fund assets reached record highs (around $3.2T-$3.5T) by end-2024, overwhelmingly driven by European inflows and market appreciation. Europe holds ~84% of global sustainable fund assets.

Regulatory Landscape

Clarifying ESG and DEI: Diversity, Equity, and Inclusion (DEI) is a critical component within the ‘Social’ pillar of ESG, focusing on human capital, representation, and workplace culture. While integrated, DEI faces distinct and intense political attacks and litigation risks in the US, necessitating careful strategic framing often emphasizing performance and talent benefits. ESG provides a broader sustainability context.

Enduring Regulatory Relevance (Beyond Federal Uncertainty): Despite the stalled SEC climate rule and potential federal deregulation under Trump, ESG regulation remains highly relevant due to state and international actions:

- California Sets the Pace: California’s SB 261 mandates biennial climate-related financial risk reporting (aligned with TCFD/ISSB) for companies with >$500M revenue doing business in the state, starting Jan 1, 2026. Its companion, SB 253, requires GHG emissions reporting for companies >$1B revenue. Given California’s economic weight, these laws create a de facto standard for many large US firms and may inspire other states.

- EU Influence (CSRD/CS3D): The EU’s Corporate Sustainability Reporting Directive (CSRD) and Due Diligence Directive (CS3D) impose comprehensive ESG reporting and supply chain due diligence requirements with significant extraterritorial reach, impacting thousands of US companies with EU operations or significant EU turnover. While potential EU simplification efforts (“Omnibus” proposal) are under review, substantial compliance obligations remain.

Recommendations for ESG Strategy in 2025

ESG is navigating a period of intense turbulence marked by political headwinds, economic uncertainty, and regulatory fragmentation. However, its strategic importance persists, driven by links to risk management, resilience, operational efficiency, talent management, and stakeholder expectations. A wholesale retreat is unlikely; strategic adaptation focusing on materiality, demonstrable value, and compliance with non-negotiable regulations (state/international) is the prevailing path forward.

High-Level Recommendations:

- Prioritize Materiality: Focus ESG efforts and resources on issues with the clearest link to financial performance, risk mitigation, and core business strategy for your specific industry.

- Ensure Compliance: Urgently assess and plan for compliance with mandatory regulations in key operating jurisdictions (e.g., California, EU), regardless of US federal uncertainty.

- Invest in Data Readiness: Strengthen ESG data collection, management, and validation processes to meet reporting requirements (TCFD/ISSB, ESRS) and stakeholder demands for transparency and credibility.

- Integrate ESG into Risk Management: Formally embed ESG considerations, particularly climate risk and human capital management, into existing enterprise risk frameworks.

- Communicate Strategically: Calibrate external communications carefully, balancing transparency demands with political/litigation risks. Focus on demonstrable impact and value creation. Avoid both greenwashing and excessive greenhushing.

- Leverage ESG for Talent: Continue investing in Social pillar initiatives as a critical lever for attracting and retaining talent.

Stay Informed & Adaptable: Continuously monitor the dynamic political, regulatory, and market landscape to inform ongoing strategic adjustments.

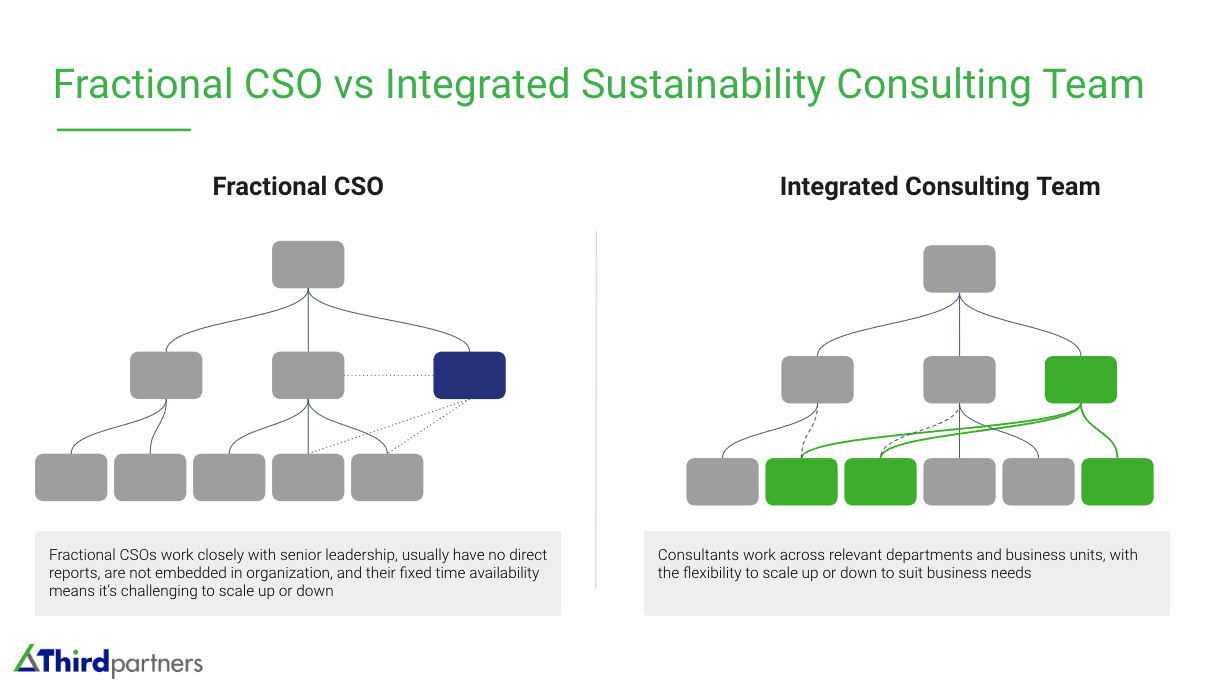

Reach out to Third Partners to understand how to effectively integrate ESG principles into your business strategy in 2025.