External expectations for ESG reports have evolved. Once focused on self-promotion and branding, ESG reports are now expected to serve as highly quantitative, data-backed resources. And in order to report, you need to prepare.

In this article, we provide guidance for first-time ESG reporters on when to begin the process and how to properly manage the project. Establish a plan with these proven strategies.

What is an ESG Report?

An ESG report highlights an organization's Environmental, Social and Governance initiatives, discloses relevant metrics, and outlines future opportunities and risks.

Successful ESG reports satisfy investor, customer, and leadership expectations with clear commitments, goals, and data representation for materially significant ESG issues.

Why Do Companies Publish an ESG Report for the First Time?

While not federally-mandated, ESG reports often represent a critical tactic of the organization's compliance strategy. As companies allocate significant resources to support the creation and distribution of an ESG report, the justification usually holds significance as well.

Common motivating factors include external expectations from investors and retail customers, or internal buy-in from top executives looking to improve impact or build legacy.

Organizations often choose to disclose in alignment with various sustainability, ESG, and impact frameworks because of the following scenarios:

- A customer requires the company to disclose according to a particular framework (CDP, THESIS, EcoVadis, etc.)

- The organization aims to achieve a score or certification that signals it is "best in class"

- Disclosing in alignment with one or multiple frameworks provides a turnkey starting point.

When Should I Begin Working on the ESG Report?

We recommend starting the process 16-18 months before the desired publication date. Smaller, more agile organizations might be capable of a faster timeline of 8-12 months, but typically still benefit from a longer preparation period and thorough action plan.

ESG reporting requires difficult decisions to be made across multiple levels and business units within a company. Some of the more critical decisions regarding goal setting and public disclosures require months of research and deliberation. Publicly commiting to meaningful statements and actions is a challenging task for any company, especially one that is privately-held and unaccustomed to public disclosure.

Proper lead time enables you to more thoughtfully identify key performance indicators (KPIs), perform accurate benchmarking, and refine your impact storytelling strategy.

Third Partners recommends an 18 month project management timeline to produce an accurate and comprehensive ESG report.

Project Management Timeline: First-Time ESG Report

First-time ESG reports benefit from an average timeline of 18 months, broken down into the following phases:

- Month 1:

Establish a project plan with a clearly defined budget, specifications, timeline and goals. - Month 2-3:

Develop a high-level outline & begin to socialize ideas with the project team. - Months 4-6:

Engage with managers from each involved department & conduct executive workshops to determine core metrics and tactics. - Months 7-10:

Collect raw data, stories, and content from internal and external collaborators. - Months 11-12:

Analyze data to establish final metrics & goals. - Months 13-14:

Create written content and visual aids that tell the story in a straightforward, user-friendly format. - Months 15-17:

Share the draft with executive stakeholders to gather and incorporate feedback. Then revise through 1-2 rounds of edits until the final draft receives approval. - Month 18:

Publish the report internally and then promote and distribute in accordance with the predetermined external communications plan.

Top 4 Steps to Prepare for an ESG Report

Consider these strategic measures as you begin the planning process:

- Build the Right Team

Recruit a working group of engaged individuals with the bandwidth and appropriate skill set to manage each component of the project: budget, project management, executive alignment, data, goal setting, design, marketing and public relations.When working with a large, diverse group of contributors, it is crucial to clearly define roles and responsibilities. We recommend staying organized with a RACI (Responsible, Accountable, Consulted, Informed) Chart. This can be especially helpful for larger organizations where approvals and edits might involve elaborate, multi-tier processes. - Prioritize High-Impact ESG Issues

Companies cannot and should not report on every single ESG issue. Determine which issues are material to your company based on industry, geography, customer base, investors, and internal stakeholders. - Consider the Audience

While ESG reports are typically geared towards a B2B audience, some companies rely upon an eco-conscious customer base who also engage with the content. Each audience consumes the report with specific attention to certain details. For instance, investors look for alignment with financial standards such as SASB or GRI, whereas B2B customers focus more on disclosure standards and environmental performance metrics related to energy, water or waste. - Align Data Collection with Key Performance Indicators (KPIs)

Start by assessing which ESG data you already have to determine which data you will need to collect, and which metrics or KPIs can be used to measure your company's sustainability performance. A comprehensive ESG report incorporates absolute, relative and intensity metrics.Intensity metrics, sometimes called efficiency metrics, are hybrid performance metrics that normalize environmental impact against other business activity metrics. Examples include energy consumed per unit of product manufactured or dollars of revenue per ton CO2e of GHG emitted.

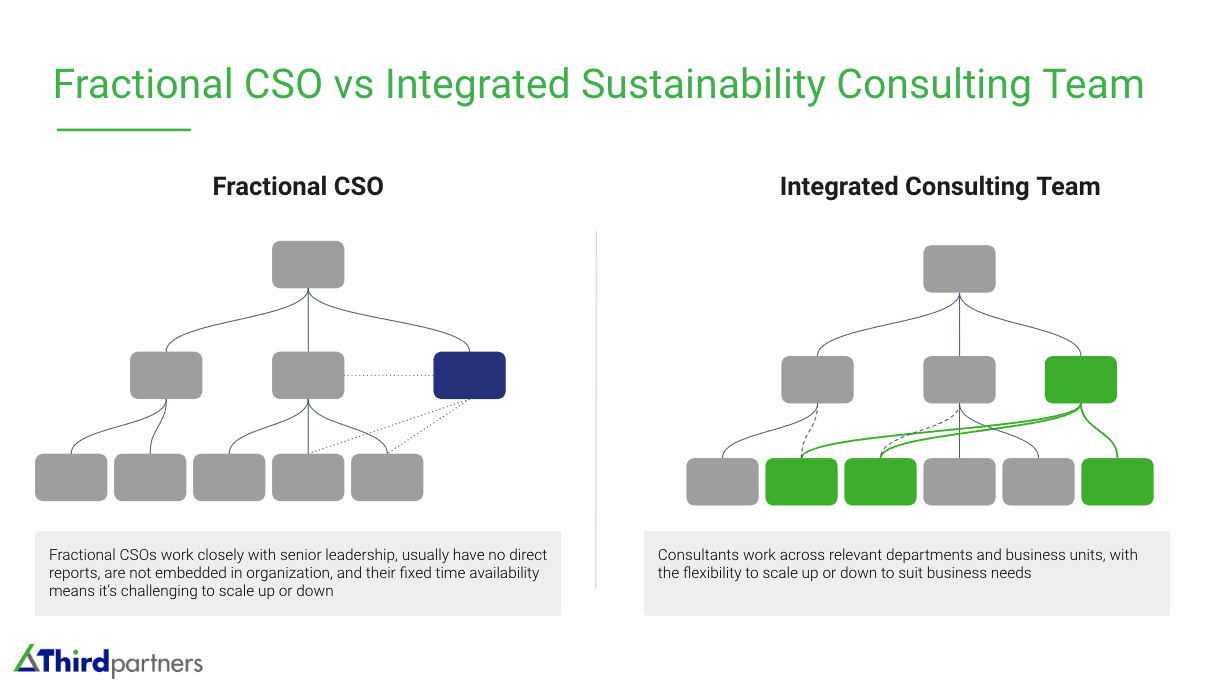

How Do Sustainability Consultants Support the ESG Reporting Process?

When companies set out to issue an ESG report for the first time, we find that teams often struggle to avoid "false starts", sometimes getting stuck in the loop of one step forward, two steps back.

As sustainability consultants, we partner with teams to ensure forward motion, improving project ROI and protecting the timeline through a range of services which include:

- Strategy Development

Following an audit for greenwashing and best practices for science-based communication, the consultant recommends how to align the structure and content of the ESG report with one or more relevant sustainability frameworks. - Project Management

While sharing turnkey templates and organizational tools with your team, a consultant provides end-to-end project management leadership for the development and publication of the report. - Collaborator Stewardship

Incorporating input from a number of clients and suppliers adds depth to the value chain and enhances the storytelling potential of your report. An ESG consultant helps identify advantageous partners and coordinates efforts to collect and operationalize their input. For a brand-heavy organization, this would include coordination with an advertising or creative agency.

In Conclusion

A comprehensive and compelling ESG report can improve your company's position with investors, B2B customers, and consumers. The team at Third Partners helps clients navigate the ESG reporting process and provides actionable guidance to strengthen your business and operationalize your commitment to sustainability. Contact us for a free consultation to learn more.