California Senate Bill 261 (SB-261) introduces significant new requirements for climate-related financial risk reporting. This legislation mandates that U.S. businesses with annual revenues exceeding $500 million that conduct business in California, must prepare a climate-related financial risk report. The reports must be prepared in alignment with the Task Force on Climate-related Financial Disclosures (TCFD) framework or sustainability-related disclosure standards under the International Financial Reporting Standards (IFRS). Reports must be made publicly accessible on the company's website. These disclosures must occur biannually and detail material risks of harm to both immediate and long-term financial outcomes stemming from physical and transition risks. The deadline for compliance with SB-261 is January 1, 2026.

This bill is a critical step towards promoting corporate accountability and transparency in the face of climate change. By requiring companies to assess and disclose their climate-related financial risks, SB-261 enables investors and stakeholders to make more informed decisions. It also pushes businesses to proactively consider and manage the financial implications of climate change, fostering a more resilient and sustainable economy.

However, assessing and reporting climate-related financial risk is not a simple task. It involves navigating complex challenges such as data collection, scenario analysis, and the inherent uncertainties of climate projections. Companies must grapple with evolving methodologies and frameworks while ensuring the accuracy and reliability of their disclosures.

How the Problem May Affect your Company:

For many companies meeting the compliance threshold, SB-261 presents both a challenge and an opportunity. These businesses, particularly those in sectors vulnerable to climate impacts, must invest time and resources to comply. This may involve enhancing their data management systems, conducting in-depth climate risk assessments, and developing robust reporting mechanisms.

The challenge lies in the complexity and the potential costs associated with these efforts. However, the opportunity lies in the chance to enhance resilience, attract investors, and gain a competitive edge by demonstrating proactive climate risk management.

Failure to comply with SB-261 can have significant repercussions for businesses. While the specific penalties for non-compliance may vary, they can include financial penalties up to $50,000 per year, legal action, and reputational damage. More broadly, non-compliance can erode stakeholder trust, hinder access to capital, and impede a company's long-term sustainability goals.

Third Partners' Approach:

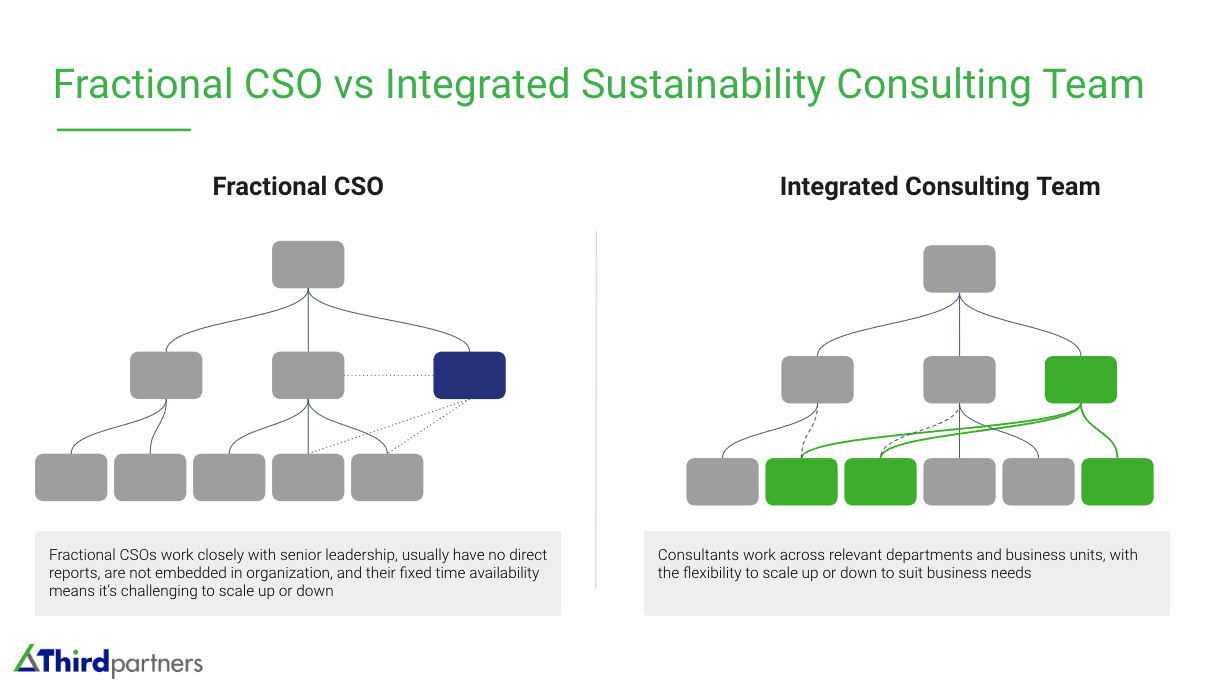

Third Partners takes a surgical approach to ESG compliance and helps you craft a compliance strategy that creates the best results for a company's reputation, risk management, and its access to capital. We utilize AI tools to keep costs low while producing a comprehensive report.

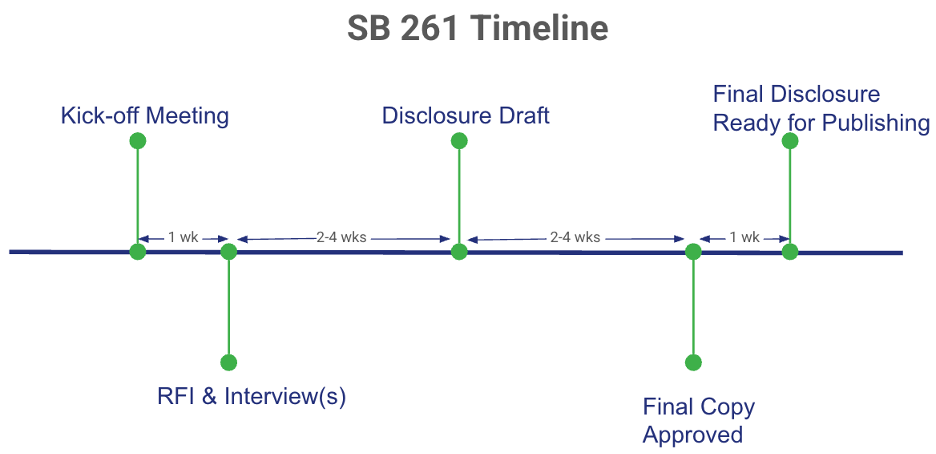

Our process is as follows:

- Kick-off Meeting – Third Partners follows The Task Force on Climate-Related Financial Disclosures (TCFD) framework to comply with SB 261. TCFD includes 4 core elements of recommended climate-related financial disclosures – Governance, Strategy, Risk Management, and Metrics and Targets.

- RFI/Interview – Third Partners will put together a list of questions from each of the four TCFD elements to gather more information about how your company manages climate-related risks and opportunities. Answers can be submitted asynchronously, or Third Partners may conduct an interview with a member of senior leadership.

- Draft Report – Using answers from the RFI, Third Partners will create a draft report and perform a detailed risk disclosure.

- Review – The client will have the opportunity for one round of edits from the Third Partners team.

- Publish Report – SB 261 requires that this report be accessible to the public, and published on the company website.

FAQ:

Why do you need a consultant for this?

- Consultants like Third Partners offer expertise in navigating the complexities of SB-261 compliance, including data collection, risk assessment, and reporting, ensuring businesses meet their obligations effectively. We have a standardized process that will save you time and headache.

What does it cost?

- The cost of consulting services varies depending on the scope of work and the specific needs of the client. Third Partners offers customized solutions to fit different budgets and requirements.

How is AI utilized to streamline compliance?

- Third Partners leverages technology and data management strategies to streamline ESG data collection, analysis, and reporting, which can include AI-driven tools for data processing and insights generation. By using AI to kickstart our process, we save time and can generate deeper insights.

To learn more about how Third Partners can help your business navigate SB-261 and turn climate risk into a strategic advantage, please request a consultation today.