Recently enacted by the European Union (EU), the Corporate Sustainability Reporting Directive (CSRD) shines a global spotlight on corporate sustainability. With profound implications for European companies and businesses worldwide, including the United States, CSRD emphasizes the importance of ESG data collection, reporting, and the promise of data-based insights.

This article explores the impact of CSRD on the U.S. economy, implementation challenges and solutions, and ways to streamline ESG data management. Consider these strategies in preparation for the new compliance requirements.

What is the CSRD?

The Corporate Sustainability Reporting Directive (CSRD) is European Union (EU) legislation that aims to promote sustainable practices and improve transparency and accountability regarding an organization’s environmental, social, and governance (ESG) impact.

Stricter Reporting

In comparison to other frameworks, CSRD introduces stricter ESG reporting requirements, including double materiality assessments and independent assurance. This makes reporting more comprehensive and transparent.

Expanded Scope

CSRD represents a substantial expansion over its predecessor, the Non-Financial Reporting Directive (NFRD) which focused on major public-interest companies. CSRD expands this scope to include all large companies, small and medium-sized enterprises (SMEs), and non-EU businesses that meet certain business thresholds within the EU.

Enforceable Mandates

Importantly, CSRD regulations have ‘teeth,’ including mandatory third-party risk assessment, audits, and evidentiary requirements that were missing from previous versions of ESG-linked laws.

“Failure to understand and align with the directive can result in supply chain disruptions, damaged business relationships, and restricted access to key EU markets.”

Élie-Adrien Mouzon, Co-Founder & CEO, ensogo

Why is the CSRD Relevant to U.S. Businesses?

CSRD has both direct and indirect impacts on U.S. companies. Large firms with a direct and significant presence in the EU market (based on meeting certain headcount, revenue, and total asset criteria) have direct reporting requirements.

Traditionally, U.S. companies have operated under more flexible, voluntary ESG reporting standards that varied by industry and stakeholder expectations. But now, CSRD requires a more standardized approach, necessitating a reevaluation of current ESG strategies and reporting mechanisms to ensure compliance.

Companies that may not be required to report directly may be impacted by CSRD indirectly. For example, EU companies subject to the CSRD may require their US suppliers to provide information on their sustainability practices. CSRD requires companies to report on their entire value chain, including upstream and downstream activities. As a result, US companies may need to comply with the CSRD’s reporting requirements in order to maintain their business relationships with EU customers.

“CSRD is the biggest shakeup ever in comprehensive, centralized ESG reporting for US firms. Its requirements go beyond the current IFRS/ISSB standards in many ways and will become yet another disclosure framework companies need to navigate.”

Adam Freedgood, Co-Founder & Principal, Third Partners

Compliance Challenges & Recommendations

For many U.S. corporations, the main challenge will be aligning current ESG reporting systems with the new CSRD reporting criteria, particularly with data granularity and external validation.

Challenges associated with the following requirements also demand attention:

Complex Reporting

Consider solutions capable of handling CSRD’s complex reporting requirements, including real-time tracking and external assurance readiness. This often involves data collection automation and centralized reporting processes to ensure consistency, accuracy, and ease of access.

Double Materiality

While many large and SME U.S. companies have already conducted “materiality assessments” to drive ESG reporting, CSRD specifies a more detailed, comprehensive double materiality assessment.

Follow a stepwise approach that considers the internal and external impacts of business operations on stakeholders and society, thinking beyond the immediate financial ramifications of social and environmental issues.

Due Diligence

CSRD’s due diligence requirements have significant implications for U.S. firms with multi-tiered global supply chains, especially those operating in or sourcing materials from countries with lax environmental and social protections.

Pay attention to the increased compliance burdens on specific commodities like forest products. It is no longer sufficient to rely on Tier 1 suppliers’ assurances regarding environmental and labor standards.

Supply Chain

To promote transparency, CSRD requires companies to obtain purchase order-level data from multi-tiered supply chains, a process that often requires an advanced technology system capable of tracking, processing, and analyzing the high volume of data needed for full environmental and social due diligence.

Emissions Disclosures

CSRD requires comprehensive disclosures across all three emission scopes, making validation and verification of greenhouse gas (GHG) data crucial. Facilitate easier audits with centralized data and automatic calculations.

The mandatory disclosure of Scope 3 (indirect) emissions is a unique feature of CSRD absent from the U.S. Securities and Exchange Commission’s (SEC) GHG disclosure rule. Technology platforms that combine supplier engagement, GHG accounting, and supply chain mapping can manage the exponential data growth associated with Scope 3 emissions.

“Organizations that wait to implement the necessary data systems, policies, and SOPs will find themselves boxed out of entire markets, or scrambling to meet buyer requirements ahead of compliance deadlines.”

John Haugen, Co-Founder & Principal, Third Partners

Early Adoption Is Key to CSRD Compliance

CSRD implementation will occur in phases from 2024 through 2029. Given the complexity and depth of CSRD requirements, a delayed response is not recommended.

With early adoption, companies will more smoothly transition into compliance and avoid market disruptions or rushed, futile attempts at process alignment, employee engagement, and implementation.

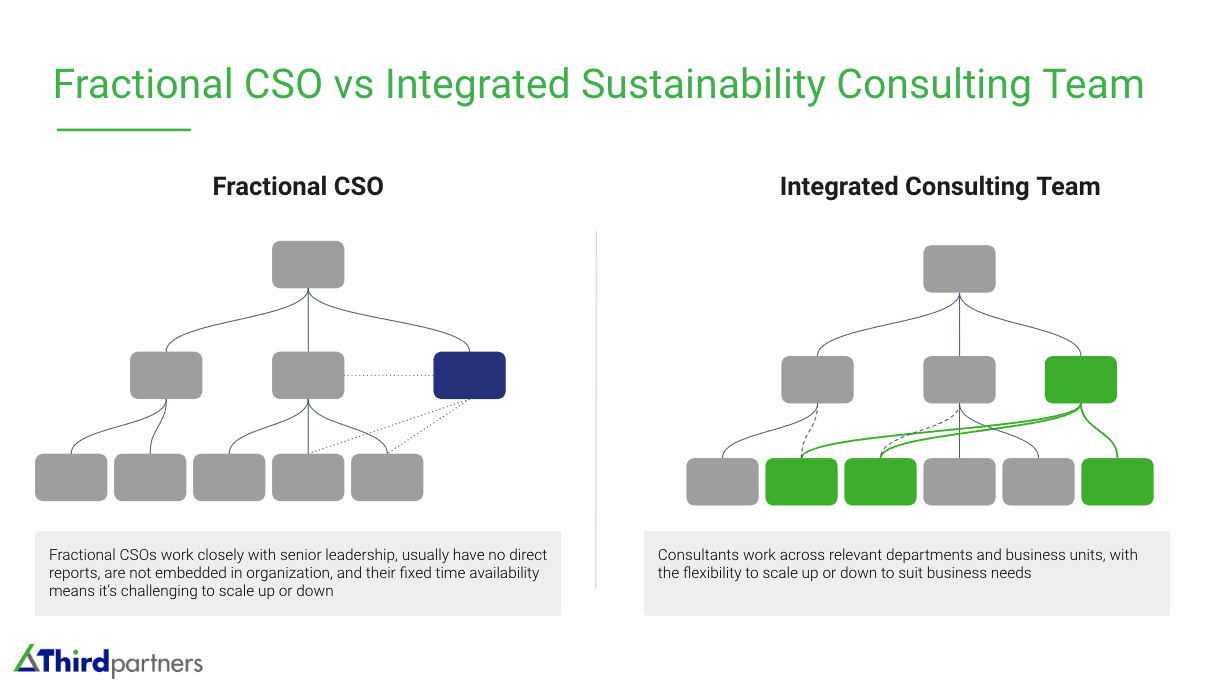

- Evaluate software and consulting options as soon as possible.

Consulting plays a key role in shaping a comprehensive CSRD strategy, while software solutions are critical for managing data and reporting. - CSRD-linked policies have specific implementation dates.

Specific compliance deadlines will vary by company and industry. For instance, those that import products made with wood and other forest-derived commodities into the EU will need to meet EU Deforestation Regulation disclosure deadlines beginning in the first and second quarters of 2025.

“Your specific compliance deadline may just be one or two purchase orders away. The time to plan for implementation is now, not when you receive an urgent request from a major customer, investor, or EU-based value chain partner.”

Élie-Adrien Mouzon, Co-Founder & CEO, ensogo

The Role of ESG Technology Solutions & Consulting

To help companies navigate the complexities of CSRD, consulting provides strategic insights to address intricate requirements like double materiality, while ESG reporting technology helps automate data collection, performance tracking, and reporting.

Software tools & resources support ESG strategy deployment.

- An ESG compliance scaffold interoperable with multiple regulatory mandates and disclosure frameworks.

- Integrated data management for an auditable, centralized repository of information.

- Continuity amid staff, leadership, and priority changes.

Software solutions also streamline the double materiality assessment process.

By compiling information, administering surveys, and assisting businesses in visualizing their organizational impact, software solutions can increase efficiency throughout the double materiality process.

Advancements in artificial intelligence further enhance these capabilities, allowing businesses to gain deeper materiality insights from their data and industry peers.

Consultants offer additional hands-on expertise to contextualize insights.

- Facilitating internal alignment through workshops and C-Suite engagement

- Helping leadership teams prioritize among critical issues

- Identifying opportunities & risks

- Aligning strategies with CSRD and other sustainability objectives.

- Managing sensitive or confidential topics that require executive-level deliberation

“Consultants help companies make informed, strategic decisions on complex priorities that involve competing interests or tension between different stakeholders.”

Adam Freedgood, Co-Founder & Principal, Third Partner

CSRD Presents Opportunities for Growth

Most importantly, companies that embrace the directive can enhance their sustainability performance and significantly reduce their impact on society and the environment.

Aligning with CSRD prepares companies for future sustainability and ESG reporting requirements, setting a high bar that may become the global standard.

Additional advantages can also include:

- Attract ESG-focused investors.

- Increase investor confidence

- Improve brand reputation

- Generate trust with stakeholders.

Over time, large institutional investors will require compliance with CSRD principles as a minimum standard across their portfolios in order to harmonize disclosures in the global economy.

Conclusion

CSRD represents a significant shift in the global approach towards corporate responsibility and ESG reporting, with considerable implications on the U.S. economy. By addressing the directive’s core requirements, U.S. businesses can ensure compliance and capitalize on the benefits of sustainable business practices.

ESG consulting together with appropriate technologies like ensogo can simplify complex environmental legislation like CSRD. Together the teams at Third Partners and ensogo help organizations navigate reporting mandates using a proven action plan process that is tailored to your specific compliance goals, budget, and internal management structure.

Contact us for a free consultation to learn more.